Introduction

Medigap vs Medicare Advantage – these two types of plans are often confused with each other as they are both provided by private insurance companies and the same private insurance companies may provide both types of plans.

However, the two programs work very differently when it comes to how they help you in terms of delivering coverage for health care costs. It’s important to understand the difference between Medigap vs Medicare Advantage.

What is Medigap?

Medigap (also called ‘Medicare Supplement’) is an insurance policy that helps to supplement Original Medicare (Part A and B) by helping to cover the ‘gaps’ in Original Medicare. Note that you cannot purchase a Medigap plan if you are on Medicare Advantage.

Original Medicare is the default option when you enroll in Medicare and is provided directly by the government. While Original Medicare will help to cover health care costs, it does not cover all costs and you are responsible for out-of-pocket costs including deductibles, copays and coinsurance. These costs are the ‘gaps’ that are being referred to when we talk about ‘Medigap‘ policies.

The most well-known out-of-pocket cost is the Medicare Part B coinsurance which is the 20% obligation that you have to pay for all outpatient medical services, such as regular doctor visits. We cover more information on what is covered by Original Medicare in our comprehensive guides on Medicare Part A and Part B.

Medigap is a policy that helps pay for these ‘gaps’ or out-of-pocket costs in return for a monthly premium that you pay the private insurance company. This premium is in addition to your Medicare Part B premium ($148.50 in 2021). Purchasing a Medigap plan effectively shifts the burden of paying for out-of-pocket costs to the insurance company and for Medicare-covered services, Medigap will effectively cover all or most of out of pocket costs that you may incur. The result is better cost predictability, in return for a higher consistent monthly premium expense.

Each ‘plan type’ provides a different level of coverage which is standardized and determined by the government. For Medicare-covered services, once Original Medicare has paid your claims, it will automatically forward them to your Medigap plan. The Medigap plan will then pay its portion of the bill.

In total, there are 10 standardized Medigap plans available: Plans A, B, C, D, F, G, K, L, M, and N. You can read more about how Medigap works and the different types of plans in our comprehensive guide to Medigap.

Medigap plans do not include Part D (prescription drugs) coverage. You must also purchase a standalone Prescription Drug Plan (PDP) plan if you want drug coverage.

What is Medicare Advantage?

Medicare Advantage (also known as ‘Part C’ coverage) plans work differently from Medigap plans. Instead of helping to pay for the costs under Original Medicare, Medicare Advantage plans are designed to be a bundled “all-in-one” alternative to Original Medicare.

Medicare Advantage plans are required by law to provide the same coverage for services covered under Original Medicare (Part A and B) but often bundle in coverage that is not included with Original Medicare such as Part D (prescription drugs) coverage as well as extra benefits such as coverage for dental, vision and hearing. When you enroll in a Medicare Advantage plan, you are choosing to receive your Medicare coverage through the plan provider rather than directly from the government (the government makes a payment each month to the private insurance carrier for the carrier to deliver you healthcare services).

Similar to insurance that you may have received previously through an employer, Medicare Advantage plans are managed care plans and often you will have to receive your care from doctors, hospitals, and other providers within the plan’s network. The most common types of plans are HMO and PPO plans.

Medicare Advantage will also have deductibles, copays, and coinsurance obligations. However, unlike Original Medicare, they also have an annual out-of-pocket limit. That means that once you have paid out-of-pocket costs that add up to the maximum annual limit, the plan will pay 100% of your medical bills for the remainder of the calendar year.

Learn how to compare Medicare Advantage Plans and avoid any mistake or penalization.

While you may have to pay a premium for your Medicare Advantage plan, however, many Medicare Advantage plans are ‘$0 premium’ plans meaning there is no additional premium on top of your standard Part B premium. In 2020, 60% of enrollees who were in a Medicare Advantage plan were enrolled in a ‘$0 premium’ plan.

You can read more about how Medicare Advantage works in our comprehensive guide to Part C.

What is the difference between medigap and medicare advantage (Medigap vs. Medicare Advantage)?

In terms of total enrollments, 24% of Medicare (around 15 million beneficiaries) are enrolled in Medigap plans, while 34% (around 22 million) are enrolled in Medicare Advantage. The bundled nature of Medicare Advantage plans has seen them gain popularity and the Congressional Budget Office (CBO) projects that Medicare Advantage enrollment will continue to grow over the next decade, with plans including about 47% of beneficiaries by 2029.

As Medigap coverage supplements Original Medicare – you cannot consider Medigap plans without first understanding the difference between Medicare Advantage vs. Original Medicare. In order to enroll in a Medigap plan, you must decide if you want to stay in Original Medicare.

But how does Medigap differ from Medicare advantage? The differences between the two often boil down to:

- Doctor choice and network – with Original Medicare you can use any doctor across the country that accepts Medicare while in Medicare Advantage may only be able to see a plans ‘in-network’ (some plans such as PPO plans will cover out-of-network doctors but at a higher cost); and

- Cost management – Original Medicare has no cap on out-of-pocket costs while Medicare Advantage has an annual maximum limit on out-of-pocket costs. In addition, Original Medicare will require you to pay 20% of the cost of care for most outpatient services which means your cost can fluctuate depending on what the health provider charges, while many services such as doctor visits for Medicare Advantage are charged on a copay (fixed dollar amount) basis which can give you more upfront certainty

Medigap plans are purchased to manage the cost of Original Medicare for those who have determined they want to stay on Original Medicare. When combined with Original Medicare plans, Medigap plans can restore some certainty to your cost obligation as they cover most of all your out-of-pocket costs in return for an additional monthly premium on top of your standard Part B premium.

As mentioned in the previous section, Medicare Advantage plans often bundle in Part D (prescription drug) and extra benefits such as dental, vision, hearing, and others which is a big reason why it has gained popularity over the last few years.

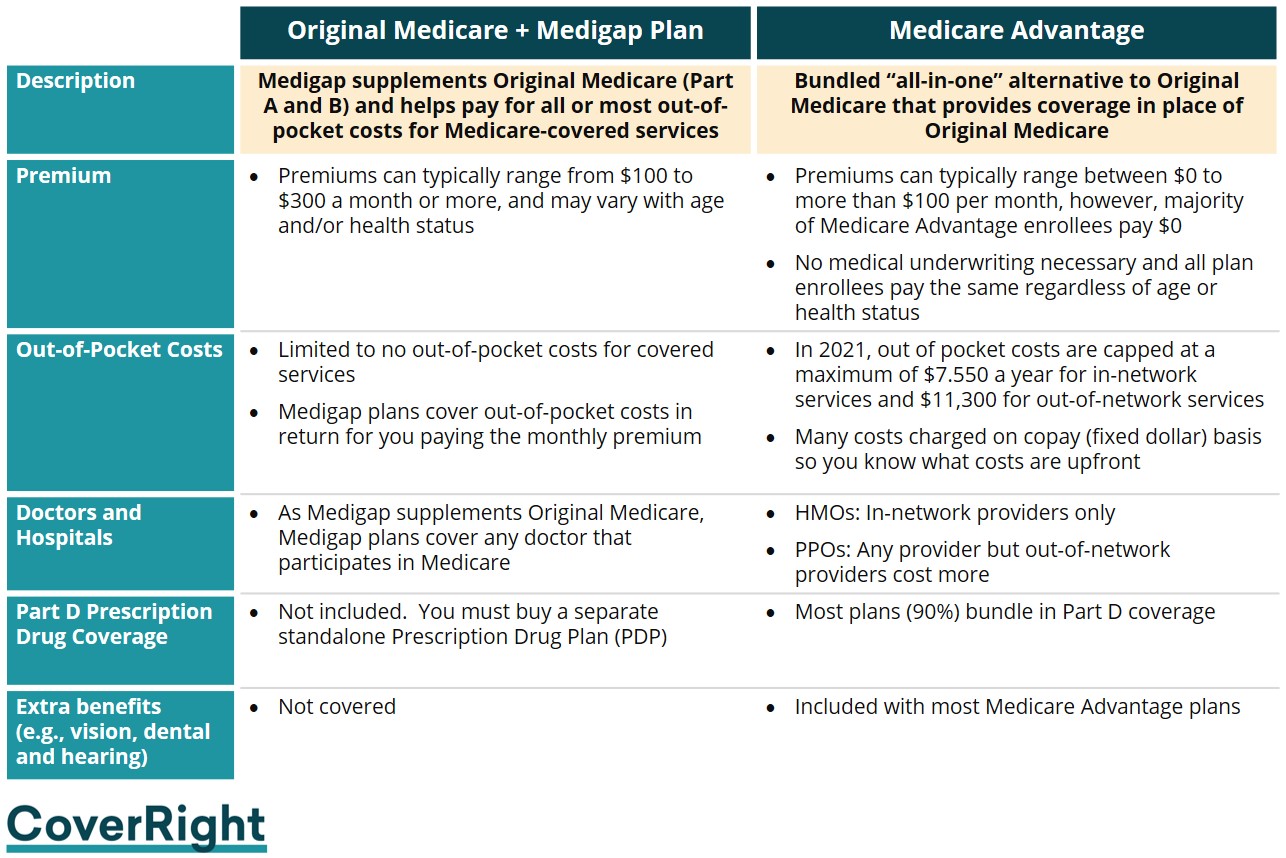

Here’s a table that summarizes the differences between the two choices:

Final Words on Medigap vs. Medicare Advantage

Medigap vs Medicare Advantage – is it better to have medigap or medicare advantage? Your choice will depend on the type of coverage you want.

Medigap plans are only for the purposes of supplementing Original Medicare and can not be used with a Medicare Advantage plan. Medicare Advantage plans are a bundled “all-in-one” in alternative to Original Medicare providing the same coverage as Original Medicare Parts A and B and often includes extra coverage for things like Part D (prescription drug) and dental, vision, and hearing.

Before you consider purchasing a Medigap plan, you should first decide whether you want to stay on Original Medicare.

At CoverRight, we’re here to help you find the right coverage that you deserve. Reach out today and start finding the best Medicare plan for you.