Introduction

You’ve been working your whole life and paying your Medicare taxes regularly. It’s only fair that Medicare is free, right?

Not exactly – the truth about Medicare is that while your contributions will help pay for some parts of Medicare, it is not entirely free. You still need to pay premiums and share out-of-pocket costs.

Leaving out Medicare costs from your personal budgeting or financial plan can be a big mistake as costs can add up.

The Key Parts of Medicare

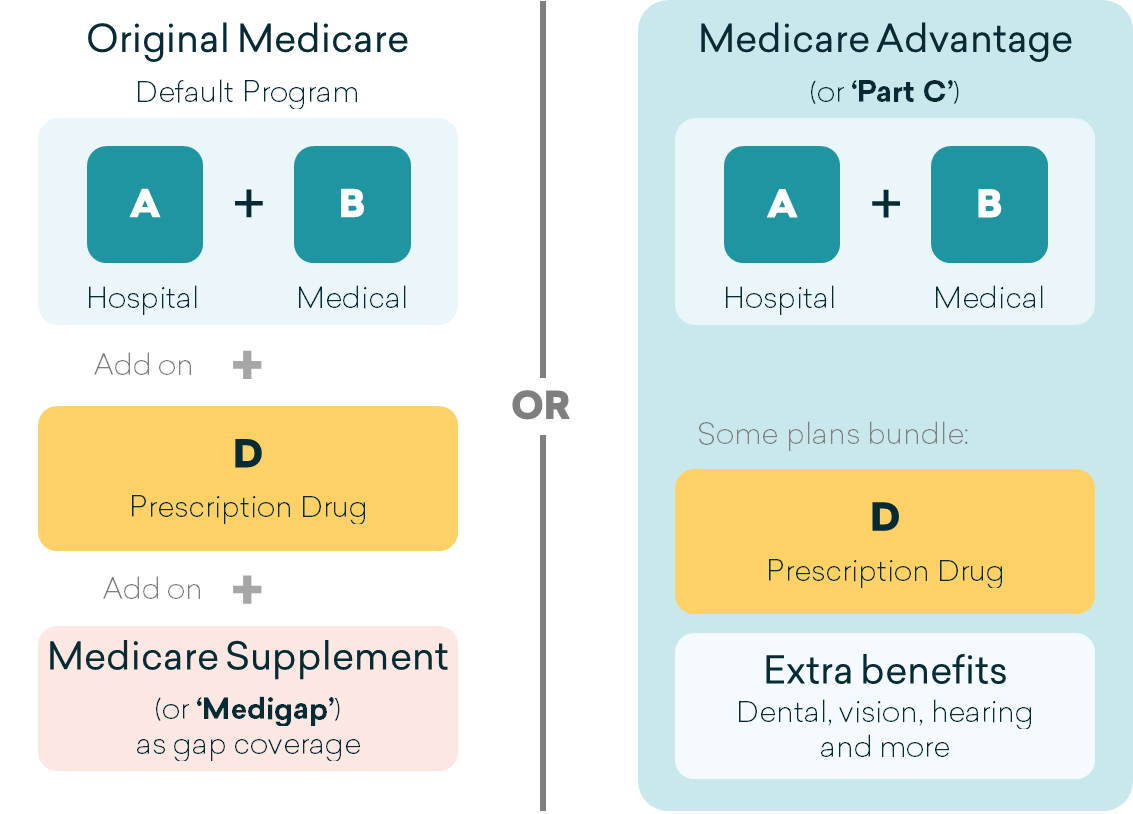

There are five (5) parts of Medicare that you need to know when considering potential costs:

| Original Medicare (Default Government Program) | |

| Medicare Part A |

|

| Medicare Part B |

|

| Private & Supplemental Coverage | |

| Medicare Part C |

|

| Medicare Part D |

|

| Medicare Supplement |

|

In summary, you can either stay in Original Medicare (Part A and B) and buy supplemental coverage or enroll in a Medicare Advantage (or ‘Part C’) plan that acts as a bundled private alternative to Original Medicare.

How Much Does Medicare Cost?

| Premium | Key Out-of-Pocket Costs (2022) | |

| Original Medicare (Default Government Program) | ||

| Medicare Part A Hospital Insurance |

|

|

| Medicare Part B

Medical Insurance

|

|

|

| Private and Supplemental Coverage | ||

| Medicare Part C *

‘Medicare Advantage’

This is an ‘alternate’ to Original Medicare

|

|

|

| Medicare Part D *

Prescription Drugs

|

OR

|

|

| Medicare Supplement *

‘Medigap’ |

|

|

* The costs range for Part C, Part D and Medicare Supplement are based on typical cost ranges.

Bottom Line: Medicare is NOT free

You will still have to pay for premiums and out-of-pocket expenses. Healthcare costs can add up. Not budgeting correctly for healthcare costs under Medicare can be a very costly mistake.

| 💡 |

Tip: Plan ahead for Medicare costs

You could be excluding thousands of dollars from your budget buy not considering the potential costs of Medicare when retiring.

In order to get estimate costs, you should always consider your premiums, deductibles, out-of-pocket obligation for both medical and drug costs under your Medicare plan(s). |

Related Posts

Why You Shouldn’t Miss Your Initial Enrollment Period (IEP)