Introduction

When looking at the options available to you for Medicare, you may have come across the term Medicare Advantage and might be wondering how it compares to traditional Medicare coverage (also known as ‘Original Medicare’).

Both Medicare Advantage and Original Medicare are alternate ways to receive your Medicare coverage, with Medicare Advantage quickly becoming a popular option as these plans often come with extra benefits not covered by Original Medicare at no additional cost.

There are, however, important considerations when it comes to deciding whether to access your Medicare through Medicare Advantage or Original Medicare.

Medicare Advantage vs. Original Medicare

Original Medicare and Medicare Advantage are two different ways to receive your Medicare coverage when you turn 65 (or if you are otherwise eligible for Medicare).

Original Medicare

Original Medicare is the government’s default health coverage and refers to the combination of Part A (Hospital Insurance) and Part B (Medical Insurance). Under Original Medicare, the federal government provides health insurance to you directly.

Most people are eligible for premium-free Part A coverage, however, everyone who enrolls in Part B is required to pay the Part B standard premium of $148.50 in 2021 (this amount may be higher depending on your income). You will also be responsible for out-of-pocket costs such as deductibles, copays and coinsurance expenses.

If you are over 65 and are a U.S. citizen, or a permanent resident who has been living in the U.S. constantly for 5 years, you are eligible for Medicare coverage and will be automatically enrolled in Original Medicare if you have already started collecting Social Security by the time you’re 65.

Medicare Advantage

Medicare Advantage (also known as ‘Part C’ coverage), is provided by private health insurance companies who are contracted with the federal government to deliver you Medicare. Under Medicare Advantage, the government provides you health insurance indirectly by paying Medicare Advantage plan providers a monthly payment for your health insurance.

Medicare Advantage is a bundled ‘all-in-one’ alternate solution to Original Medicare and is required by law to at least provide the same coverage you would receive for Part A and Part B insurance under Original Medicare. Medicare Advantage often includes additional extra benefits such as Part D prescription drug coverage and dental, vision and hearing.

Everyone who is eligible for Original Medicare is also eligible for Medicare Advantage. However, once you enroll in a Medicare Advantage plan you no longer receive coverage through Original Medicare and must receive care in accordance with your plan provider’s policies.

You will still need to pay your standard Part B premium if you are in a Medicare Advantage plan. You may also be required to pay an additional premium to the plan provider depending on the plan you choose.

Medicare Advantage is not the same as, and should not be confused with, Medicare Supplement (also known as ‘Medigap‘) insurance. Medigap is supplemental coverage you can purchase to help cover the out-of-pocket costs of Original Medicare. Read our article on Medigap vs. Medicare Advantage for more information.

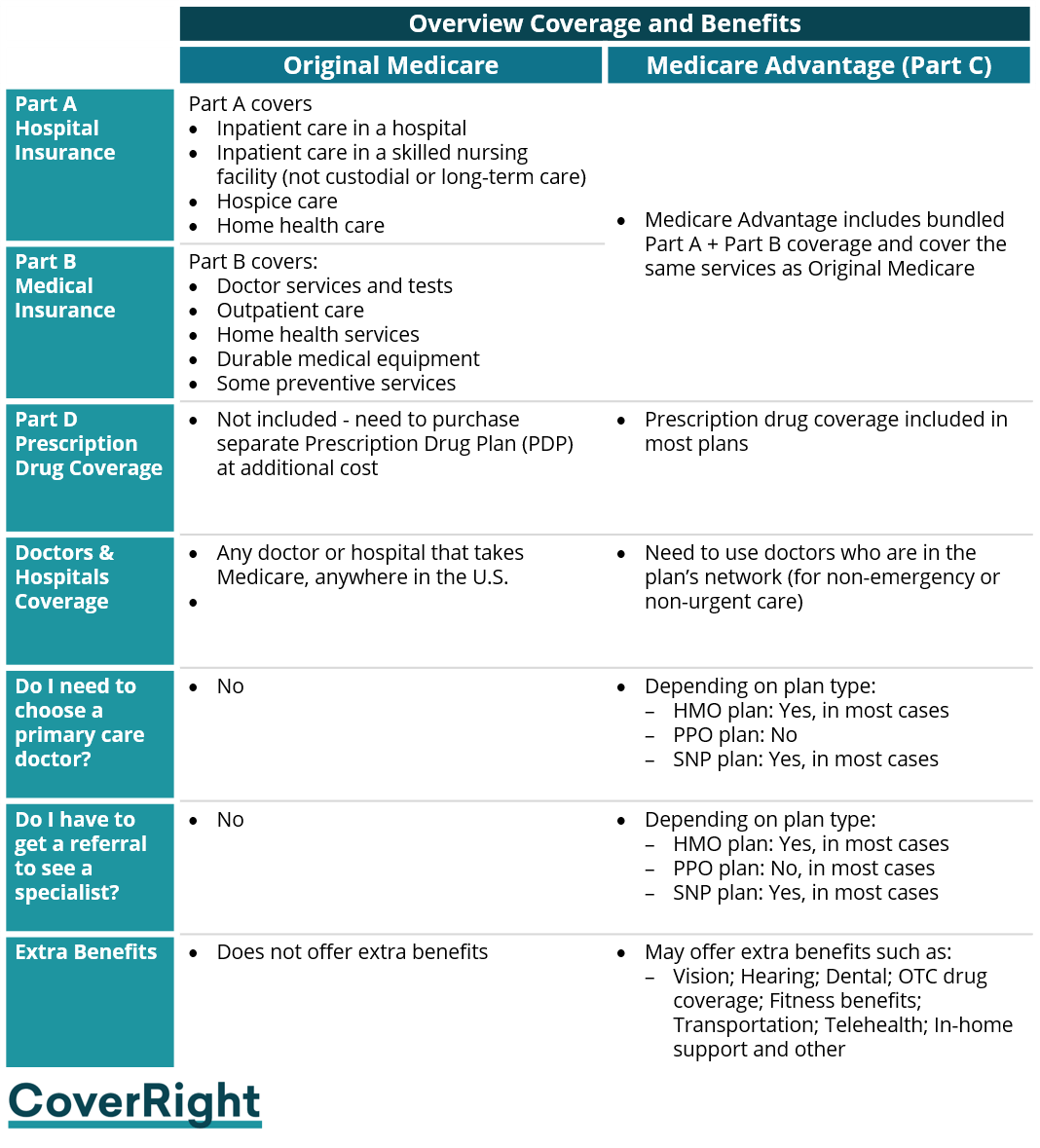

What does Medicare Advantage cover relative to Original Medicare?

Health insurance companies that provide Medicare Advantage plans are required by law to deliver at least the same coverage as Part A and Part B insurance that you would receive under Original Medicare.

However, there are some differences to consider when you are deciding whether you want to receive your coverage through Original Medicare versus Medicare Advantage:

Doctor and Hospital Networks

With Original Medicare, you can use any doctor or hospital that takes Medicare, anywhere in the U.S. While the CMS (the Centers for Medicare and Medicaid Services) does not publicly track specifically how many doctors are in the U.S. accept Medicare patients, the Kaiser Family Foundation research has found that 93% of primary care providers surveyed accepted Medicare. However, only 72% of them were taking new Medicare patients.

With Medicare Advantage, you’ll in most cases need to use doctors who are in the plan’s network. Some plans may offer out-of-network coverage but often at a higher cost.

Medicare Advantage plans are typically split into a few different categories:

- Health Maintenance Organization (HMO) plan

- Preferred Provider Organization (PPO) plan

- Special Needs Plan (SNP)

You may be familiar with HMO or PPO if you have previously had a group or employer-sponsored insurance. Each type of plan has different restrictions in terms of which doctor and hospital networks are accessible to you. SNPs are made available to help deliver integrated care that better suits the needs of special needs beneficiaries such as those with chronic conditions.

You may also come across Private-Fee-for-Service (PFFS) and Medical Savings Accounts (MSA) plans which are far less common (<1% of enrollees are enrolled in these plans). These types of plans may have a wider network than HMO and PPO.

Prescription Drug Coverage (Medicare Part D)

Original Medicare does not come with Prescription Drug Coverage (also known as Medicare Part D). In order to get coverage for prescriptions with Original Medicare, you need to purchase a separate Prescription Drug Plan (PDP) from a private health insurance company. This means you pay an additional premium each month. The average standalone PDP plan premium across the country was $41 for 2021 according to the Kaiser Family Foundation.

In 2021, 89% of Medicare Advantage plans offer prescription drug coverage (known as ‘MA-PD‘ plans). You are not required to pay a separate monthly premium with MA-PD plans.

Extra Benefits

Medicare Advantage plans often offer extra benefits that Original Medicare doesn’t cover— like vision, hearing, dental, and wellness programs (e.g., gym memberships). This is a big reason why Medicare Advantage plans have been gaining popularity amongst seniors across the country in recent years.

In 2021, most Medicare Advantage plans also offer extra benefits beyond what Original Medicare covers, including fitness (96%), dental (92%), eye exams and glasses (91%), and hearing aids (88%). Just over half (55%) of Medicare Advantage plans provided a meal benefit, such as a cooking class, nutrition education, or meal delivery, and over one-third (36%) provide some form of transportation benefit.

Health insurance companies are also increasingly covering additional extra benefits than they have in the past, including services like telehealth, over-the-counter drugs, adult day-care services, and other health-related services that promote your health and wellness.

This is great for you as the consumer, and you should always check your options annually to make sure you are getting the most out of the plans available.

What does Medicare Advantage cost relative to Original Medicare?

When you are assessing the difference in the costs between Original Medicare and Medicare Advantage, you need to consider:

- The cost of having insurance in place (i.e. premiums); and

- The cost of utilizing that insurance, which is also known as ‘out-of-pocket costs’ (i.e. deductibles, co-pays, and co-insurance)

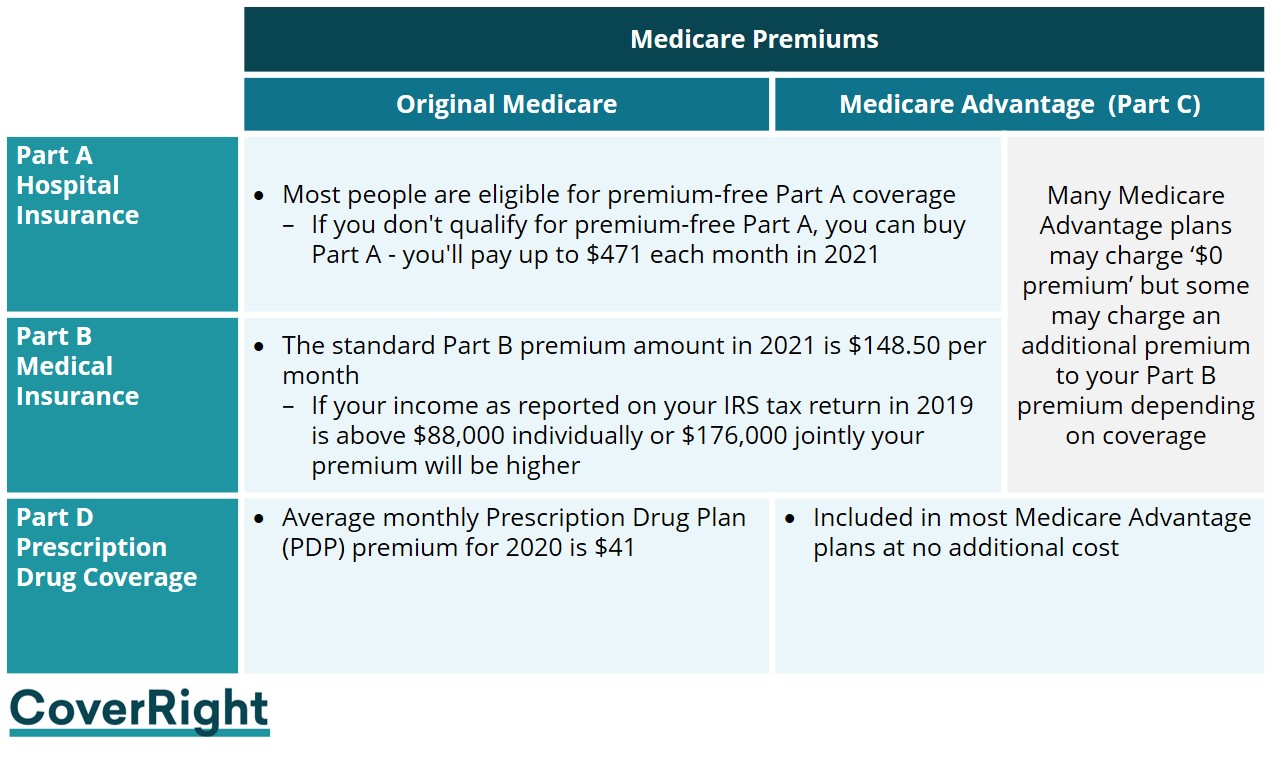

Premiums

Premiums are the monthly payments you need to make in order to have insurance coverage in place.

Regardless if you are selecting Medicare Advantage or Original Medicare you are required to pay your Part B premium (and any Part A premium, if applicable).

The standard Part B premium amount in 2021 is $148.50 per month, although you may need to pay a higher premium depending on your income. Each year Medicare premiums, deductibles, and copayment rates are adjusted in accordance with the Social Security Act.

Under Original Medicare, if you choose to purchase a standalone Part D Prescription Drug Plan (PDP), you’ll pay that premium separately.

For Medicare Advantage, you may need to pay a premium for the plan in addition to a monthly premium for Part B depending on your coverage.

In 2021, the majority of Medicare Advantage plans for individual enrollment (89%) will include prescription drug coverage. In addition, more than nine out of ten beneficiaries (96%) will have access to an MA-PD with ‘$0 premium’.

What is a ‘$0 premium’ Medicare Advantage Plan?Medicare Advantage plans can be advertised as ‘$0 premium’ plans. This means that there is no additional premium on top of your Part A (if applicable) and Part B premium that you are already paying. In 2020, nearly two-thirds (60%) of Medicare Advantage enrollees paid no premium (other than the Part B premium). For more information read our article on $0 premium plans. |

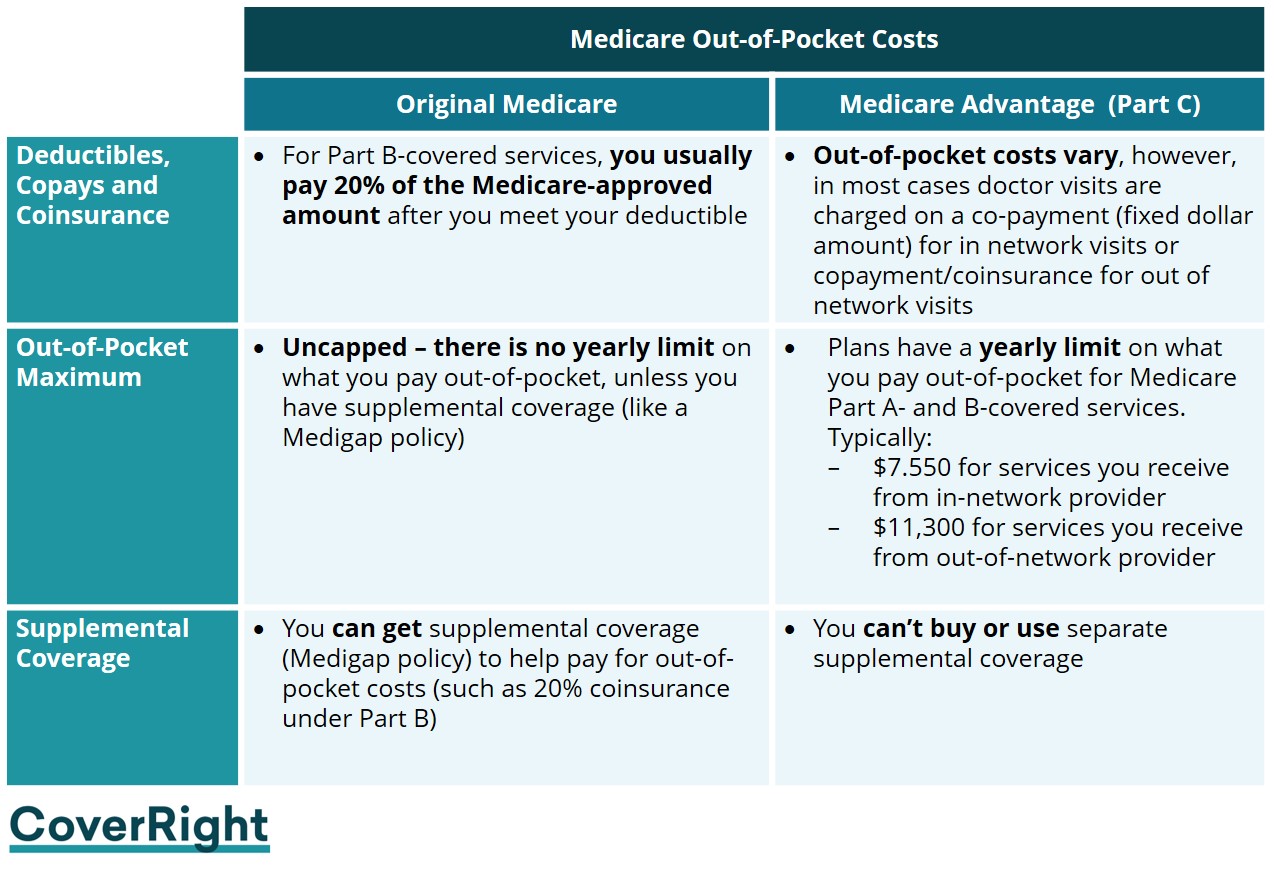

Out-of-Pocket Costs (deductibles, copays, and coinsurance)

Out of pocket costs are expenses that are not reimbursed by Medicare and include costs such as deductibles, co-pays, and coinsurance:

- Deductibles: is a dollar threshold amount paid out of pocket by you, before your insurance pays for any expenses.

- Copays (Copayments): is a fixed dollar amount you pay for covered medical services. Typically, copays are charged after a deductible has already been met and your insurance kicks in. In some cases, copays are applied immediately.

- Coinsurance: is a fixed percentage you pay for covered medical services. Co-insurance is charged after the deductible has already been met and your insurance kicks in.

Deductibles, co-pays, and co-insurance will vary depending on if you receive your coverage through Original Medicare or Medicare Advantage. The major differences between the two to highlight are:

- Coinsurance vs. Copay: For Part B-covered services, under Original Medicare, you usually pay a fixed 20% of the Medicare-approved amount after you meet your deductible whereas for Medicare Advantage out-of-pocket costs vary depending on the plan. However, in most cases, doctor visits are charged on a co-payment basis (fixed dollar amount typically in the range of $0 – $20 for your primary care doctor).

- Out-of-pocket maximum: There’s no yearly limit on what you pay out-of-pocket for Original Medicare unless you have supplemental coverage (like a Medigap policy). For Medicare Advantage, plans have a yearly limit on what you pay out-of-pocket for Medicare Part A- and B-covered services. Once you reach your plan’s limit, you’ll pay nothing for Part A- and Part B-covered services for the rest of the year.

- Supplemental Coverage: For Original Medicare, you can get supplemental coverage (like a Medigap policy) to help pay your remaining out-of-pocket costs (like your 20% coinsurance). As previously mentioned, you cannot buy Medigap coverage if you are on Medicare Advantage.

Is Medicare Advantage or Original Medicare right for you?

The answer, as with most health and financial services questions is that it depends. The cost-benefit equation will come down to your health situation as well as health-related and financial preferences. In particular:

- How much do you value flexibility in terms of doctor and hospital network?

- Your need for prescription drug coverage and/or extra benefits and whether you’re willing to pay extra for these (versus having them included in a plan at no additional cost)?

- What is your health situation and how likely are you to incur significant health costs (for example, do you have a chronic illness)?

- What is the monthly budget you are comfortable with?

Final Words

It’s fair to say that comparing across Original Medicare and Medicare Advantage can be complex. However, we at CoverRight are here to help you accurately decide what coverage you should get for your situation.

We pair the latest technology with a team of friendly licensed agents, we can help you remove the guesswork and through these trade-offs.