You’re watching television and up pops one of those commercials to “help you” pick a Medicare plan.

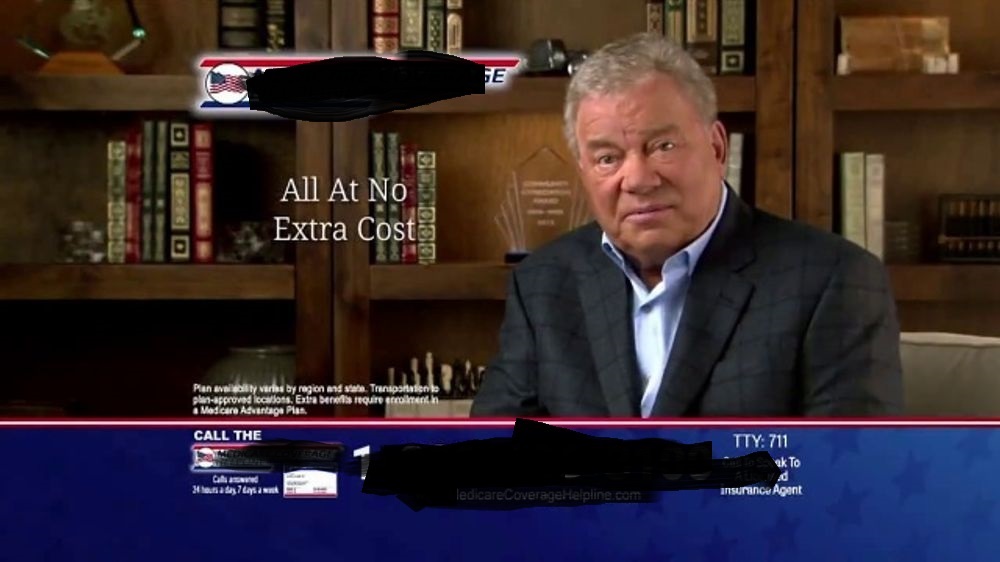

By “those” commercials, we mean ads that feature a celebrity spokesperson who is pitching a particular company’s Medicare plan. The spokesperson in question is probably someone you remember from years past. He or she could be a former athlete, a singer you liked “back in the day” or an actor who played a supporting role on a television show you loved once upon a time.

A quarterback who got sacked thousands of times, an actor who played a quirky neighbor on a sitcom, or a singer who had a hit when you were in high school? Why should you think they know much about selecting something as important as picking a Medicare plan?

Why have the advertisers selected those spokespeople to pitch their Medicare products? You already know why. The advertisers think that people who are old enough to be receiving Medicare will be influenced by celebrities who were popular 30, 40 or even 50 years ago. But as you have already concluded on your own, there is no reason to allow yourself to be influenced by them. The advertiser is only using them to establish an emotional connection with you.

To quote from “The Benefits of Companies Using a Celebrity Spokesperson,” an article that AJ Agrawal wrote for Forbes on April 12, 2016, “Building brand awareness through a celebrity spokesperson will gain a brand instant publicity. In the long-term, it will encourage more and more customers to find out more about the business their favorite celebrity happens to be supporting.”

Who Is Better to Rely On When Picking a Medicare Plan?

CoverRight’s licensed Medicare advisors are always available to help, and there is no charge or obligation to enroll.

Why use CoverRight? Part of what makes Medicare so confusing is that it’s not a single plan you simply opt into once you turn 65. Medicare is segmented into a variety of public and private plans, and you have to enroll in the right bundle to get all the coverage you need.

CoverRight demystifies choice-making and helps you find out which combination of Medicare coverage is best suited to your specific situation.

Free Medicare Resources

Related Posts

Critical Considerations Many Seniors Miss When Signing Up for Medicare

When Does Your Medicare Coverage Become Effective?

Friends Don’t Let Friends Get the Same Medicare Plan