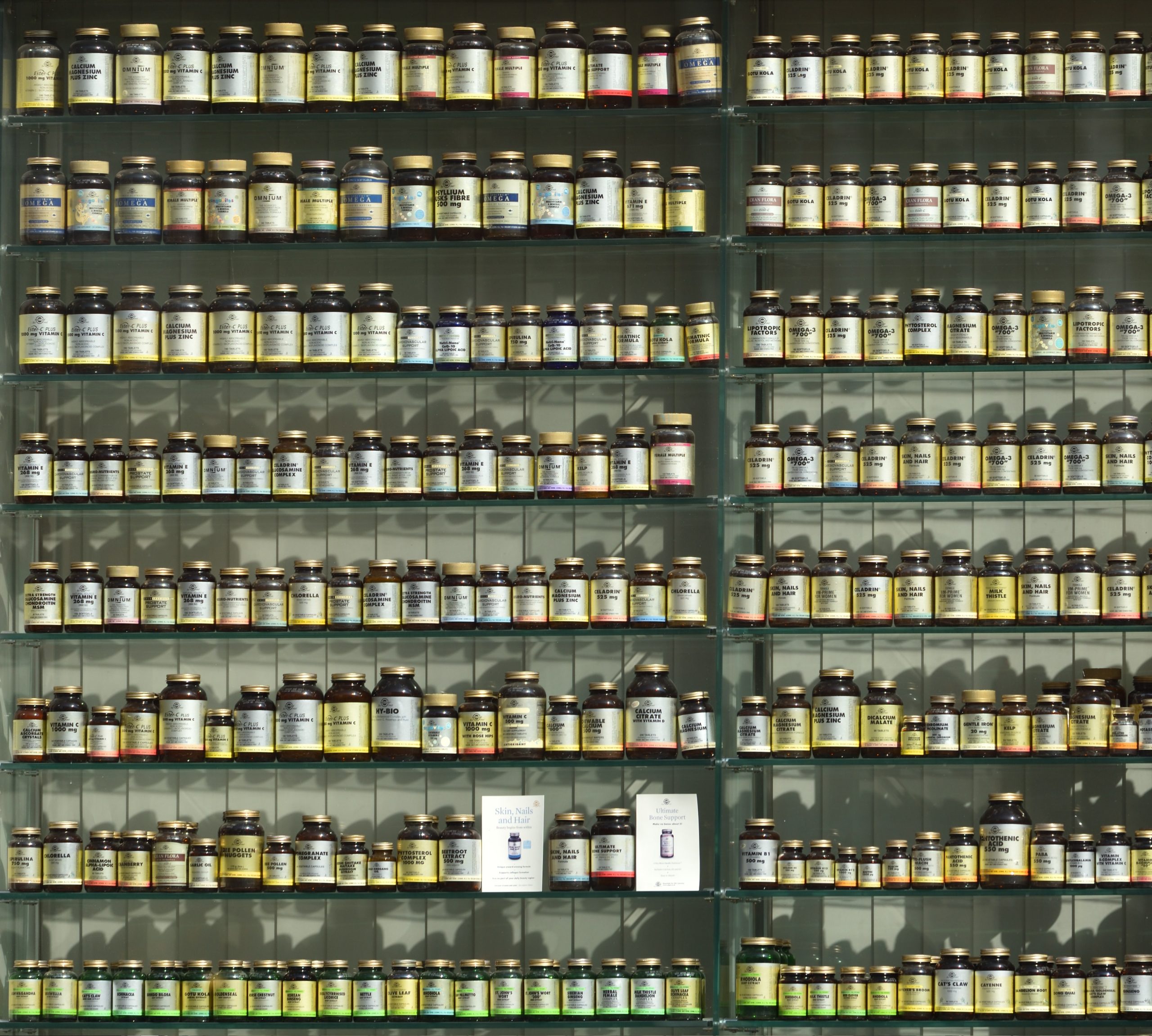

Introduction to Medicare and Over-the-Counter Medications

Medicare is a federal insurance program that provides coverage to people who are 65 years old or older, as well as individuals with certain disabilities or medical conditions. This program is divided into several parts, each of which provides different types of coverage. While Medicare covers a wide range of medical expenses, it is important to understand what it does and does not cover. One question that frequently comes up is whether Medicare covers over-the-counter (OTC) medications.

In this blog post, we will explore this topic in detail.

Medicare Coverage of OTC Medications

In general, Original Medicare – the default government program – does not cover the cost of OTC medications, including vitamins and supplements, unless they are prescribed by a doctor. This means that if you need to purchase over-the-counter medications and are on Original Medicare, you will likely need to pay for them out of pocket. However, there are some exceptions to this rule. For example, Medicare Part B may cover certain OTC medications that are used to treat specific conditions, such as allergies, if they are prescribed by a doctor. Furthermore, many Medicare Part D prescription drug plans will also not cover OTC medications.

However, for Medicare beneficiaries who choose to enroll in a Medicare Advantage plan. may offer coverage for OTC medications as an added benefit. In fact, the research by Kaiser Family Foundation notes that 87% of Medicare Advantage plans have OTC coverage.

Medicare Advantage Plans

Medicare Advantage plans are a type of Medicare coverage that is offered by private insurance companies. These plans are an alternative to Original Medicare, and they often offer additional benefits that are not covered by Original Medicare, such as vision, dental, and prescription drug coverage.

The majority of Medicare Advantage plans also offer coverage for OTC medications, such as pain relievers, cold and flu medications, and allergy medications. Typically plans will specify a quarterly allowance that you can spend on OTC goods.

However, it is important to note that not all Medicare Advantage plans offer this coverage, and the specifics of the coverage may vary from plan to plan. In addition, Medicare Advantage plans may require you to purchase these OTC goods from a specific provider and/or catalog.

Conclusion

In conclusion, Original Medicare does not generally cover the cost of over-the-counter medications, with a few exceptions.

If you are interested in OTC coverage, you should consider a Medicare Advantage plan. It is important to carefully review the details of any Medicare Advantage plan you are considering. As always, it is important to discuss any questions or concerns you may have about your Medicare coverage with your healthcare provider or a licensed insurance agent.

Understanding what Medicare covers and does not cover can be confusing, and over-the-counter medications are just one of the many areas where the rules can be unclear. However, with a little research and some guidance from your healthcare provider or an insurance agent, you can make informed decisions about your healthcare coverage and ensure that you are getting the care you need.

———————————–

CoverRight is on a mission to make the Medicare plan selection process easy to understand. We are here to help you compare Medicare plans and find the one best suited to your specific situation. Try the platform for yourself.

Free Medicare Resources

Cost Plus Drugs and Medicare FAQs

Related Posts

What Can a Licensed Insurance Agent Offer?