Introduction

In the U.S., 1 in every 3 Medicare beneficiaries has diabetes, and over 3.3 million Medicare beneficiaries use one or more of the common forms of insulin.

The rising cost of healthcare has always been a significant point of concern for many Americans suffering from severe conditions. In particular, for those suffering from diabetes, the cost of insulin has been a critical pain point as costs have continued to increase over the years. This has historically created significant problems for those suffering from affordability issues with insulin who often have to make significant tradeoffs such as reducing other necessary day-to-day expenses, or more often than not, reducing adherence to prescribed insulin dosages in order to manage costs.

While the impact financially can be significant, non-adherence to prescribed dosages can result in significant health risks such as the increased risk of serious complications, ranging from vision loss to kidney failure to foot ulcers (potentially requiring amputation) to heart attacks.

New 2021 Part D plans for insulin coverage

Thankfully, change is on the horizon for diabetic Americans who eligible for Medicare.

The Centers for Medicare and Medicaid Services (CMS) recently announced that in 2021, over 1,600 Medicare Part D prescription drug plans will offer lower insulin costs. In particular, these will offer insulin at no more than a $35 monthly copay beginning on January 1, 2021.

This will be available both for beneficiaries who receive Part D coverage through standalone Prescription Drug plans (PDPs) and those who receive Part D coverage through Medicare Advantage. These new 2021 plans will be part of a pilot cost savings program run by the CMS called the ‘Part D Senior Savings Model’.

What is the Part D Senior Savings Model?

Part D Senior Saving’s Model is a voluntary pilot program that kicks in for the calendar year 2021. The aim of the program is for the CMS, along with various participating Part D insurance plan providers and pharmaceutical companies (Eli Lilly and Company, Novo Nordisk and Sanofi-Aventis) to test the impact of giving Medicare beneficiaries better choices and options for out-of-pocket insulin costs.

At its crux, the Part D Senior Saving’s model effectively removes a previous barrier in the way costs were shared between Part D plan providers and pharmaceutical companies, which dis-incentivized Part D plan sponsors to lower cost-sharing for Medicare beneficiaries.

What does the Part D Senior Savings Model mean for me?

This change now enables Part D plan providers to lower cost-sharing to no more than $35 for a month’s supply for a broad set of insulins, drastically improving costs for Medicare beneficiaries who need insulin. CMS has noted that research shows that once copays reached $50, many recipients stop taking insulin or take less than the prescribed dose.

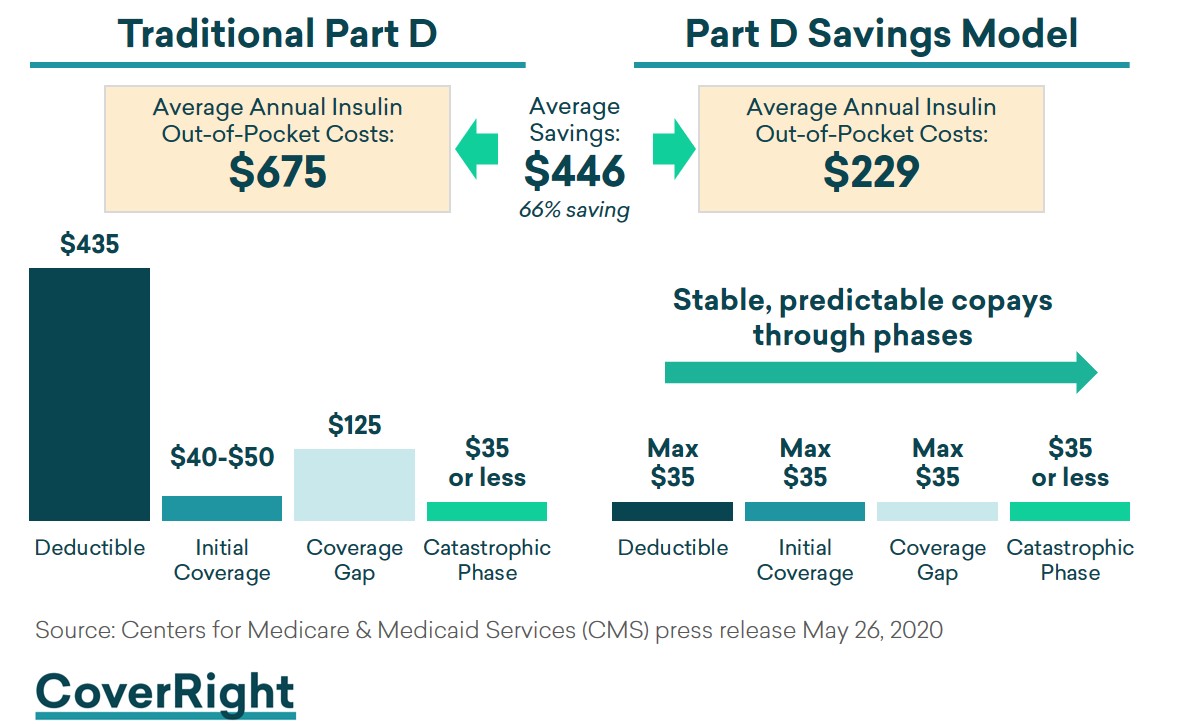

Under the recent changes set to be implemented in 2021, Medicare enrollees who enroll in a participating Part D plan in 2021 will experience average savings of up to $446.

To understand how this works and compares to ‘non-savings model plans’, we must first describe the 4 ‘coverage phases’ of Part D plans which are summarized below. For those that are new to Part D plans you can read more about this in our Comprehensive Guide to Part D.

- 1) Deductible: Deductibles vary across Part D plans; however, the government sets the maximum deductible chargeable by plans ($480 in 2022, $445 in 2021). You must pay for 100% of drug costs until you reach your deductible before your Part D insurance kicks in.

- 2) Initial coverage: After you reached your annual deductible you enter the ‘Initial Coverage’ phase. During this period, you will be responsible for copayment/coinsurance costs as determined by your Part D plan provider. Plans will categorize their formularies into cost-sharing ‘tiers’ which will typically determine the copayment/coinsurance you will make for the drug you are filling.

- 3) Coverage “Gap” (previously known as the ‘Donut Hole’): Once you reach $4,430 of total out-of-pocket spend during the Initial Coverage phase you enter what is traditionally known as the ‘Coverage Gap’ phase. This phase was previously also more commonly called the ‘Donut Hole’. During this phase, your coinsurance obligation during is 25%. For example, if a bottle of insulin costs $250 you will be responsible for paying $62.50 during the coverage gap.

- 4) Catastrophic Coverage: In 2022, once you have reached $7,050 in out-of-pocket costs during the Coverage Gap phase, you will enter Catastrophic Coverage. Once you reach Catastrophic Coverage you lower copays and coinsurances, typically the greater of 5% coinsurance or $9.20 for branded drugs and $3.70 for generic drugs.

As outlined below, the program aims to create more stable cost-sharing across all 4 stages of Part D coverage (versus, the variability under the traditional model).

Do I Automatically Get Part D Senior Savings Model?

The savings are not automatic. It’s essential to remember that Part D plans are optional, and beneficiaries must actively opt into those plans.

You must select and enroll in the new plans participating in the Part D Senior Savings Model to get these savings. You also need to adhere to the available insulins from participating pharmaceutical companies to receive the price cap; otherwise, you may face higher costs if you remain at a different insulin brand. The policy also applies only to people ages 65 and older.

According to the CMS, the average monthly premium for basic Medicare drug plans is $32.09 in 2020, while ‘enhanced plans’, which include plans such as those plans that are participating in the Medicare Part D Senior Savings Model, have an average premium of $49.32 a month.

It’s important to also note that the Part D Senior Savings Model is a pilot program and subject to changes and adjustments based on the results and success of the program in 2021. CMS has noted that will review how the program performs in 2021 and determine whether any amendments are needed as time goes on.

CMS Administrator Seema Verma also said that: “If it goes well, we’ll extend this to other drugs. We’re starting with insulin, but depending on the progress, we will consider offering this flexibility to manufacturers and plans with other drugs, depending on the results. We think this creates a foundation and a platform to fix things, some of the problems that we have in the Part D plans.”

Final Words

1 in every 3 Medicare beneficiaries has diabetes, and over 3.3 million Medicare beneficiaries use one or more of the common forms of insulin. In 2021, the Part D Senior Savings Model will enable Medicare beneficiaries with diabetes to access critical insulin coverage more affordably, capping the cost at $35 for those who enroll in participating Part D plans.

Medicare beneficiaries who rely on insulin should take the opportunity during Medicare Annual Open Enrollment (also known as ‘Annual Election Period’) between October 15 and December 7 to review their Part D options.