If you ask someone for advice about picking a Medicare plan, chances are good that person will say, “Oh, they’re all about the same.”

But if you start to investigate, you find that your choices are not that simple. You will need to understand Medicare Parts A, B, C and D, not to mention copay amounts, drug coverage, deductibles, and other variables. You may also hear about PPOs (“Preferred Provider Organizations”) and HMOs (“Health Management Organizations”).

So, who are you going to ask for advice? Let’s consider your options.

Friends and Family

In general, these contacts fall into two categories.

People with no experience or limited knowledge. Often, people in this group signed up for Social Security and Medicare in previous years and they aren’t paying too much attention to it because it seems to be working for them.

For people in the group, they’ll be helping you if they say, “I don’t know enough to offer you advice, you’ll have to explore it on your own.” A statement like this is more helpful than offering advice that is inaccurate or incorrect.

People with some knowledge and plenty of opinions. You know when you’re talking to someone like this – they have opinions and advice that they are eager to share with you – the question is whether what they are telling you is accurate or biased.

While this source may be someone your trust, it’s important to take this advice with care. Medicare plans change year to year and plans are not one size fits all. For example, your source may have different doctors, drugs, and health requirements to recommend to you – not picking a plan that is optimized for you can cost you hundreds if not thousands extra.

Professionals

This category includes your accountant, attorney, primary care provider, and other professionals. However, just because these experts have a professional certification in their field doesn’t mean they can advise you about Medicare.

Medicare is specialized health insurance unlike group health insurance or marketplace plans. What makes it complex is that there are public and private options with unique rules. Making a mistake can result in lifelong Medicare penalties.

Medicare.gov

Medicare.gov offers a variety of resources that explain the basics of Medicare. However, 73% of people find Medicare.gov hard to use. In addition, what Medicare.gov does not offer is expert, individualized advice that matches plans to your needs, health concerns, financial situation, and other factors you need to consider to make the Medicare choices that are best for you.

Traditional Brokers

Traditional brokers from different plan providers can be good sources of information. While they will sell you their companies’ products, that does not mean they will not take the time to discuss your needs and priorities and try to match you with a plan that will work well for you. However, traditional brokers are not required to search a minimum number of plans, disclose the number they do search or financial incentives to favor particular plans.

CoverRight – a Simple, Seamless Solution

Ultimately, you are responsible for finding the right Medicare plan for you. And remember that if you commit to a plan that you do not like, you might not be able to change it until the following October, when the annual Open Enrollment period begins.

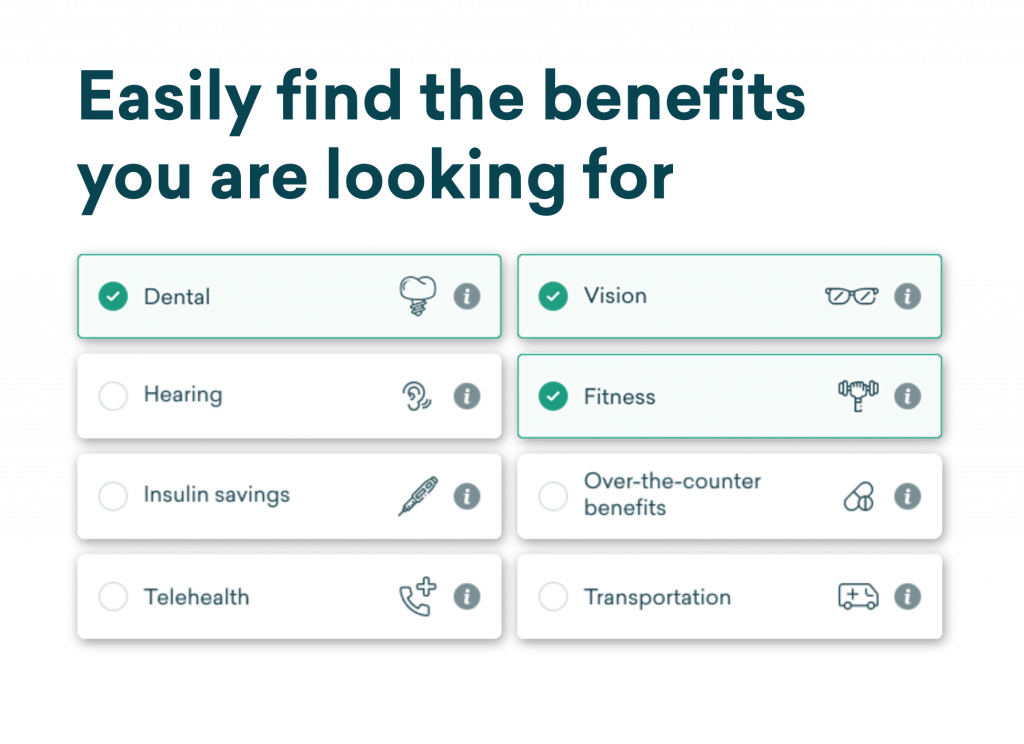

At CoverRight, we’ve built the first digital Medicare concierge to help you navigate the process and make the right decision. Our platform will guide you through the process and make personalized recommendations based on the information you provide. You get access to instant quotes from 20+ top national insurers and to a dedicated licensed advisor who will take the time to ask the right questions and suggest the best plan options for you. There is no fee for these services.

Explore our Medicare Learning Center of simple, easy-to-consume videos, webinars, podcasts, and blog resources. You will find answers to questions about plans, coverage, and other considerations.

And we are here to answer your questions.

Related Posts

Are you one of the 30% of eligible people missing out on Medicare savings?

Do you need Medicare if you have other health insurance?

Medicare Advantage Mistakes: Cancelling Part B or Enrolling in a Separate Drug Plan

The Biggest Medicare Mistake: Missing Your Medicare Supplement Open Enrollment Period

Don’t be a statistic. Do you understand your Medicare coverage?