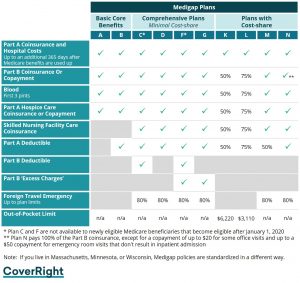

This Medicare Supplement Comparison chart, from Medicare.Gov, could be a useful tool for comparing different Medigap Plans to understand what each plan covers. Each plan is Federally standardized so all insurance carriers who offer the “plans” provide coverage for the same healthcare costs based on the government guidelines.

Use it to compare the Medigap plans you are considering and to understand the coverages for each plan letter.

Even Though This Template Is Helpful, Remember…

“Shopping for a Medicare Plan” means comparing Medicare plans that are sold through commercial insurance companies, not by the government. (Remember that you don’t need to “shop” for Original Medicare Parts A and B, you enroll directly from Medicare.gov, probably at the same time you are signing up for Social Security.)

When you go shopping for a Medicare plan, you are looking at plans that provide all your coverage in one bundle or supplemental coverage to the original Medicare program that will cover gaps in Original Medicare. Note that you are not required to sign up for additional coverage but there are many gaps in Original Medicare that if not covered may cost you down the road. (If you are not sure how these gaps work and the associated costs give us a call.)

Medicare Supplement plans (also called Medigap plans) let you stay enrolled in Original Medicare Part A and Part B, and cover the expenses that Medicare itself will not, such as emergency medical coverage when you’re traveling outside of the U.S., deductibles, and other out-of-pocket expenses. These plans have up-front costs but almost no other expenses when you use services.

Be sure to sign up when you first become eligible to get a Guaranteed Issue plan and avoid underwriting

“Guaranteed issue” means that the insurance company guarantees that it will issue you a policy at the best rate without any underwriting for health or preexisting conditions. You cannot be denied a policy.

Bear in mind that guaranteed issue only applies to Medicare Supplement plans (aka Medigap) where you get supplemental Medicare insurance from a private insurance company. This concept doesn’t apply to Medicare Advantage (which is always available to anyone who needs coverage (during applicable enrollment windows)).

As with all things Medicare there are windows of time when you can sign up or make changes. To qualify for a guaranteed issue Medicare supplement plan, you must enroll within the first six months after signing up for Part B. Or if you have a Special Enrollment Period (SEP) that qualifies you for enrollment, you must sign up then. (Note not all Special Enrollment circumstances qualify for a guaranteed issue period.)

Decide whether to get Plan G, Plan N or one of the other plans

As you shop for a Medicare Supplement Plan, you will learn that there are 10 different government-standardized plans. The two most popular are Medicare Supplement Plan G and Medicare Supplement Plan N.

Neither Plan G nor Plan N covers your Part B deductible, which is $233 in 2022. But once you have met that deductible for the year, your plan will pay the rest.

Both Plan G and Plan N policies cover many of the costs that Original Medicare doesn’t. For instance, they will cover:

- Blood (first three pints you receive)

- Foreign travel emergency care (may vary by policy)

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance

- Part A hospice care coinsurance or copayment

- Skilled nursing facility coinsurance

- Your Medicare Part A deductible ($1,556 in 2022)

Note that Supplement Plan G policies cost more and provide more extensive coverage than Plan N policies do. Plan N policies will not cover certain add-on charges that health care providers can add to your bill.

In addition, Plan N policies do not cover copays for office visits. So read the fine print. You could learn, for example, that your Plan N policy will only pay for your emergency room visit if you are admitted as an inpatient; if you are not, you could be hit with a hefty bill for your visit.

The bottom line is, to learn everything you can about your policy type before you enroll and get some expert guidance.

Be sure to ask about a household discount

When you sign up for a Medicare Supplement Plan, you could get a household discount of up to 12-15%. Learn how the discount might apply to you.

And Check Out this Interactive Comparison Tool from the Medicare Experts at CoverRight.com

See 20+ Medicare Supplement Plans Comparisons on the CoverRight platform. This is a customized comparison you complete based on your personal data.

We hope that the advice in today’s article will help you use that comparison chart to understand the different plans, consider all the “moving parts” and pick the plan that will cover your healthcare needs.

And Remember, CoverRight Medicare Advisors Are Ready to Guide You

To Learn More, Contact a CoverRight Medicare Expert Today!

———————————–

CoverRight is on a mission to make the Medicare plan selection process easy to understand. We are here to help you find the best Medicare plans suited to your specific situation. Try our self-guided Medicare quiz to see for yourself.

Free Medicare Resources

Recent Posts

What You Need to Know When Comparing and Shopping for a Medicare Plan

How to Evaluate a Medicare Plan

How to Simplify Your Medicare Decision

Medicare Advantage or Medicare Supplemental Plan . . . Which Is Better?