Introduction

Traditionally Medigap Plan F has been the most popular (with 53% of Medigap enrollees purchasing in a Plan F). However, you may have heard that it is no longer being sold.

Read this article to find out more about Medigap, why Plan F was so popular, and who can actually still purchase this plan.

What is Medigap?

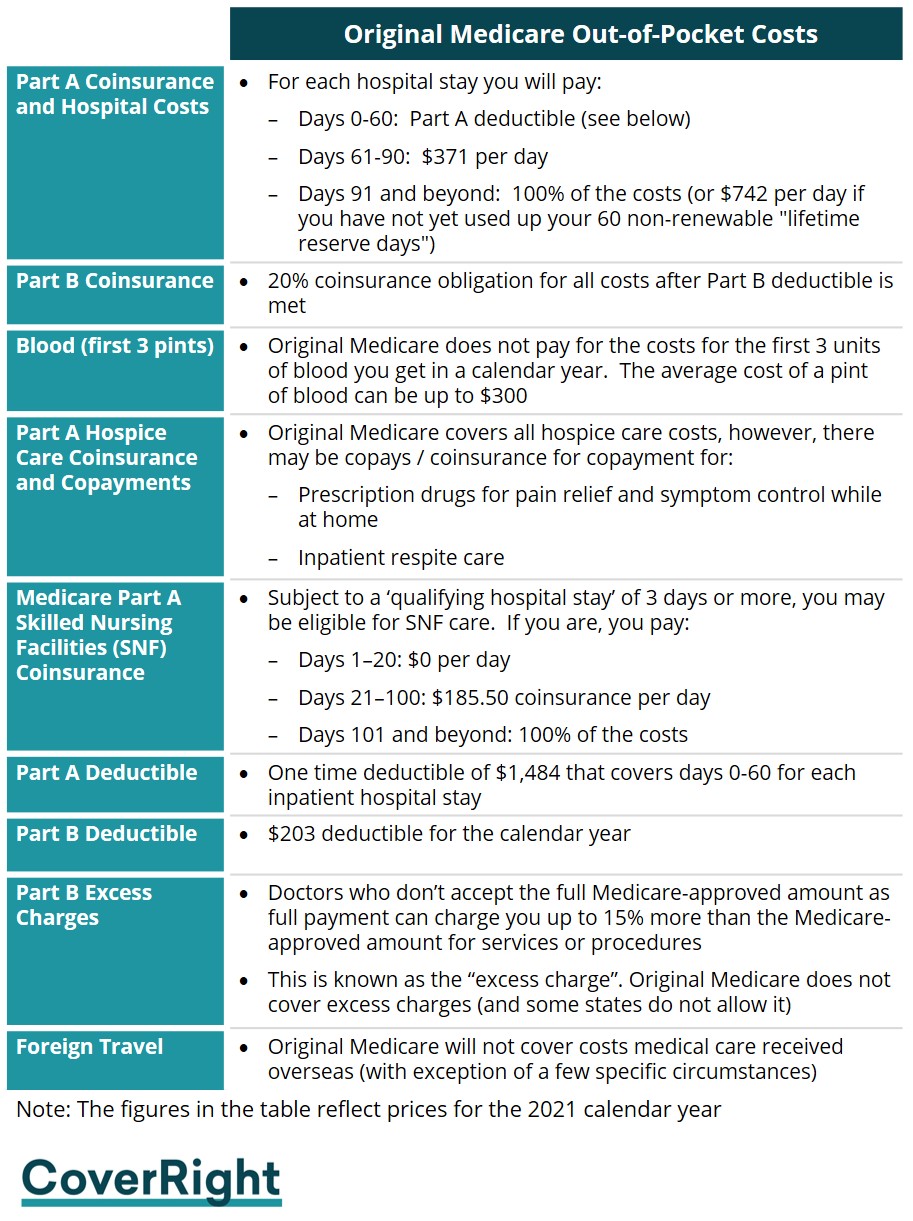

Medigap plans are (also called ‘Medicare Supplement’) insurance are insurance policies sold by private health insurance companies to help pay for the out-of-pocket costs (also called ‘gaps’) for Original Medicare Part A and Part B. These out-of-pocket include deductibles, copays, and coinsurance.

In total, there are 10 Medigap plans available: Plans A, B, C, D, F, G, K, L, M, and N. You can read more about how Medigap works and the different types of plans in our comprehensive guide to Medigap.

Medigap plans are standardized by law and so there is no difference in purchasing a Plan A from Company A and Company B. As such when comparing the different private health insurance companies your choice comes down to price and the insurer’s reputation.

Medicare Supplement Plan F

Medigap Plan F has traditionally been the most popular choice as it provides the most comprehensive coverage for Medicare beneficiaries. As seen in the table below, Medigap Plan F covers more out-of-pocket costs than any other plan.

Is Medigap Plan F no longer available?

Starting in 2020, rules have changed so that Medigap plans that pay the Medicare Part B deductible will no longer be sold to those newly eligible for Medicare on or after January 1, 2020. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). This means that both Plans F and C cannot be purchased if you are newly eligible, however:

- If you were eligible for Medicare before January 1, 2020, you are still eligible to purchase a Medigap Plan F or Plan C

- If you are already enrolled in a Medigap Plan F (or Plan C) you may continue to stay enrolled in that plan

How much is the Medicare Part B deductible?

In 2021, the Medicare Part B deductible is $203. This is the amount you have to pay before Part B pays for covered services. This amount is covered by Plan F (and C) and will no longer be covered by Medigap plans for newly eligible Medicare beneficiaries.

What are some other options other than Plan F?

If you become eligible for Medicare after January 1, 2020, the closest plan you can purchase is Medigap Plan G. Traditionally Plan G has been the next most popular plan after Medigap Plan F with 17% of Medigap enrollees purchasing a Plan G.

Medigap Plan G has the same benefits as Plan F, except that it does not cover the Part B deductible. For more information on Plan G read this article. A second alternative is Medigap Plan N which is similar to Plan G but you will have more out-of-pocket costs with it. With Plan N you in addition to the Part B deductible which is not covered under Plan G, you are responsible to pay:

- Maximum of $20 for doctor visits and $50 for ER visits

- Excess Charges (if any)

A high-deductible version of Plan G might become available in 2020. With this option, you must pay for Medicare-covered out-of-pocket costs (coinsurance, copayments, and deductibles) up to a deductible amount of $2,340 before the policy pays anything.

Final Words

Plan F (and C) will no longer be available to newly eligible Medicare beneficiaries after January 1, 2020. If you were eligible prior to January 1, 2020, or already enrolled in a Plan F (and C) prior to this date, you are still allowed to purchase or stay in these plans. For newly eligible Medicare enrollees Medigap Plan G and N will be the next best alternatives if you are looking for comprehensive Medigap coverage.

At CoverRight, we’re here to help you find the right coverage that you deserve. Reach out today and start finding the best Medicare plan for you.